No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under licence. This article accounting for research and development has been prepared for informational purposes only and gives a general overview of research and development amortization. It’s highly recommended to consult with a tax professional to ensure that taxes are properly calculated and reported.

The way businesses account for the money they pour into R&D doesn’t just end up on their balance sheets; it also plays a vital role in how much tax they owe. And there’s been a big shake-up in this area, thanks to the Tax Cuts and Jobs Act (TCJA). Handling research and development expenses is all about finding the right balance. On one hand, we want to recognize that spending money on research and development could lead to big benefits down the road, like new products or better ways of doing things. On the other hand, there’s always a bit of uncertainty with R&D because it’s not often clear which projects will succeed and which ones won’t. What we will dive into are the type of expenses that create value for years to come, typically referred to as capital expenditures (CapEx) or capitalized expenses.

International Valuation Standards Council (IVSC)

The costs of generating other internally generated intangible assets are classified into whether they arise in a research phase or a development phase. Development expenditure that meets specified criteria is recognised as the cost of an intangible asset. For an expense to be classified as an asset, it must meet specific criteria set by accounting standards, such as those outlined by such the U.S. Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Before the TCJA, businesses could deduct these costs right away, which gave them an instant discount on their tax bill for every dollar they spent on innovation. But now, with the new law that started in 2022, companies https://www.bookstime.com/articles/payroll-automation have to spread those deductions and amortize those intangible R&D costs we talked about. Now that we’ve got clarity on how companies spread out the costs of their R&D projects over time, it’s time to pivot to taxes.

Recognition as assets

After initial recognition, an entity usually measures an intangible asset at cost less accumulated amortisation. It may choose to measure the asset at fair value in rare cases when fair value can be determined by reference to an active market. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

- Instead of expensing the $1 million as it’s incurred, the company capitalizes this cost as an intangible asset and what happens afterward is depreciation or amortization of those costs.

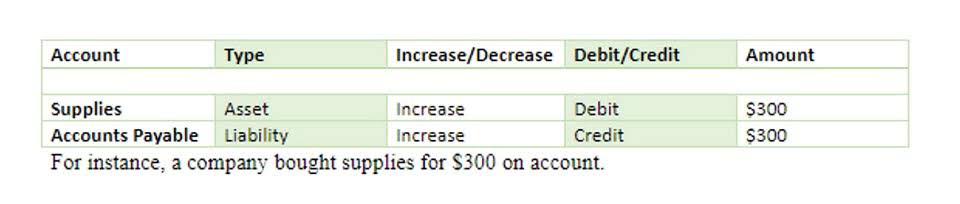

- Expenses can turn into assets when the money spent on certain activities is expected to provide future economic benefits beyond the current accounting period.

- As we’ve seen, the path laid out by GAAP and IFRS offers different strategies for capturing the essence of your research and development efforts, each with its implications for your financial statements and tax liabilities.

- While IFRS also expenses research costs, IFRS allows the capitalization of development costs as long as certain criteria are met.

- In our experience, the key factor in the above list is technical feasibility.

- Research

SSAP 13 states that expenditure on research does not directly lead to future economic benefits, and capitalising such costs does not comply with the accruals concept.

US GAAP requires that interest expense, interest income and dividend income be accounted for in the operating activities section, and dividends paid be reported in the financing section. Equally, the argument exists that it may be impossible to predict whether or not a project will give rise to future income. As a result, both the UK and International Accounting Standards provide accountants with more information in order to clarify the situation.

FIRM INNOVATION AND RESEARCH & DEVELOPMENT COSTS UNDER IFRS

Regardless, the new regulations are critical for any business, large or small. Generally, under GAAP, research and development costs are expensed (charged to an expense account) as they are incurred, since any future economic benefit arising from development of a given asset is uncertain. The costs of intangible assets acquired through R&D activities are expensed differently, depending on whether there is a future alternative use for the asset. If the asset has a future alternative use, it becomes a capitalized asset, meaning its cost will be depreciated over its useful life and the amortization costs are expensed. If the asset does not have a future alternative use, its cost is expensed upon acquisition. The development costs of a company are those costs incurred through the process of developing improved or new goods and services to meet consumers’ needs and, ideally, increase the company’s profits.

Leave a Reply

Want to join the discussion?Feel free to contribute!