Check out this articletalking about the seminars on the accounting cycle and thispublic pre-closing trial balance presented by the PhilippinesDepartment of Health. What is the current book value ofyour electronics, car, and furniture? Are the value of your assets andliabilities now zero because of the start of a new year? Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt. Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period. Once this is done, it is then credited to the business’s retained earnings.

AccountingTools

It can be a calendar year for one business while another business might use a fiscal quarter. Manually creating your closing entries can be a tiresome and time-consuming process. And unless you’re extremely knowledgeable in how the accounting cycle works, it’s likely you’ll make a few accounting errors along the way. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship). Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them. This time period, called the accounting period, usually reflects one fiscal year.

What is Income Summary?

- At the core of this suite is the Financial Close Management solution, which simplifies and accelerates financial close activities, ensuring compliance and reducing errors.

- During the accounting period, you earned $5,000 in revenue and had $2,500 in expenses.

- Accounts can be closed on a monthly, quarterly, semi-annual or annual basis.

- Since QuickBooks automates the year-end close, you don’t have to get caught up with all of these manual entries unless something was to go wrong.

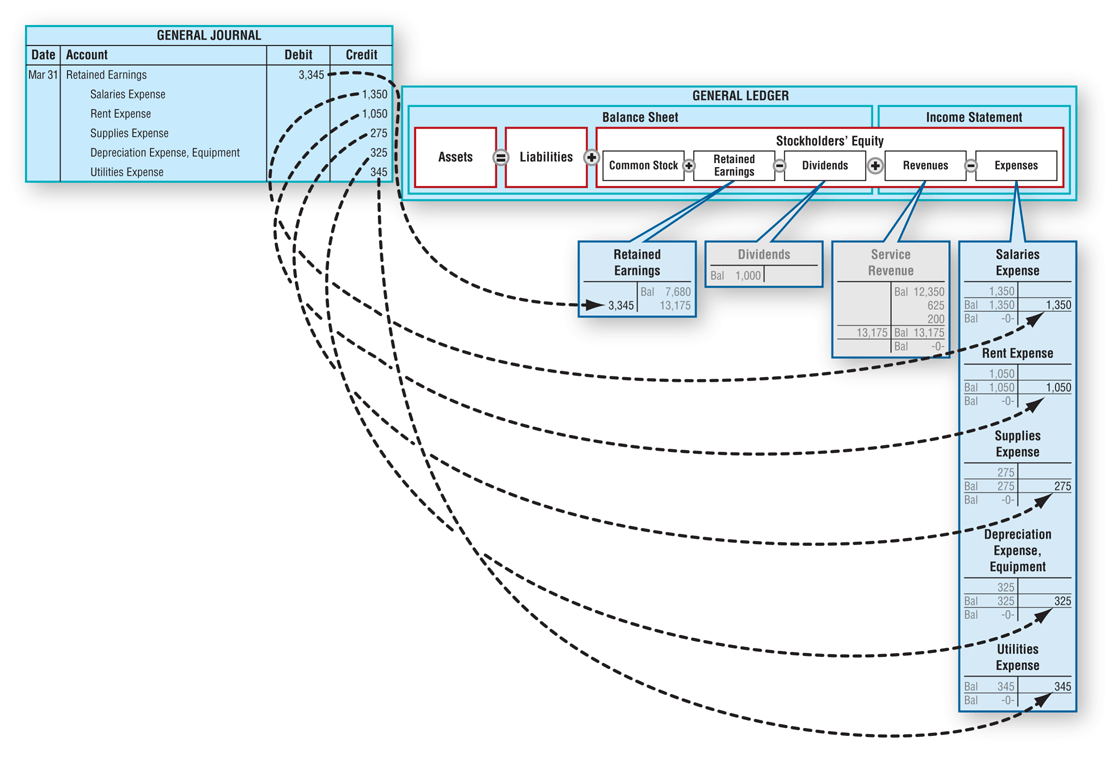

The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account. Finally, transfer any dividends to the retained earnings account.

Would you prefer to work with a financial professional remotely or in-person?

There may be a scenario where a business’s revenues are greater than its expenses. This means that the closing entry will entail debiting income summary and crediting retained earnings. But if the business has florida gas prices sit at 10 recorded a loss for the accounting period, then the income summary needs to be credited. Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account.

Unit 4: Completion of the Accounting Cycle

The term can also mean whatever they receive in their paycheck after taxes have been withheld. The term “net” relates to what’s left of a balance after deductions have been made from it. Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. Instead, as a form of distribution of a firm’s accumulated earnings, dividends are treated as a distribution of equity of the business. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

The income summary account is then closed to the retained earnings account. Closing entries are necessary to reset the balances of temporary accounts to zero and to update the Retained Earnings account. Next, transfer the $2,500 in your expense account to your income summary account. First, transfer the $5,000 in your revenue account to your income summary account. Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses. Because expenses are decreased by credits, you must credit the account and debit the income summary account.

Theclosing entry will credit Dividends and debit RetainedEarnings. Thebalance in the Income Summary account equals the net income or lossfor the period. This balance is then transferred to the RetainedEarnings account. The accounts that need to start with a clean or $0 balance goinginto the next accounting period are revenue, income, and anydividends from January 2019. To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019.

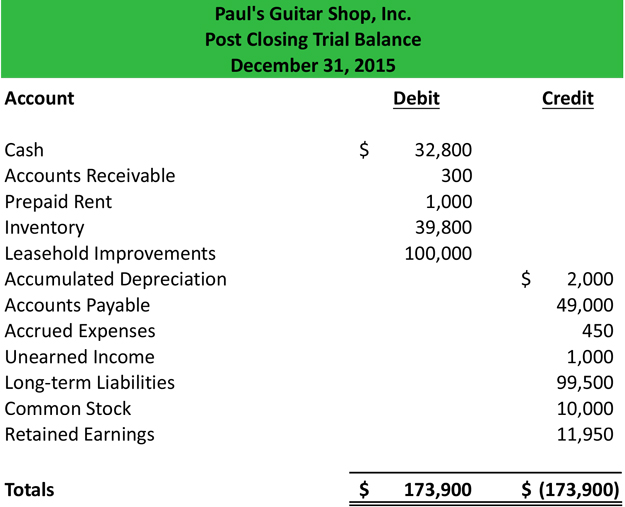

Companies are required to close their books at the end of eachfiscal year so that they can prepare their annual financialstatements and tax returns. However, most companies prepare monthlyfinancial statements and close their books annually, so they have aclear picture of company performance during the year, and giveusers timely information to make decisions. Thebusiness has been operating for several years but does not have theresources for accounting software.

By maintaining your bookkeeping, you can ensure that you are constantly kept informed. As well as being consistently up-to-date on the financial health of your business. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. We have completed the first two columns and now we have the final column which represents the closing (or archive) process. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance. You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app.

The second entry requires expense accounts close to the IncomeSummary account. The expense accounts have debit balances so to get rid of their balances we will do the opposite or credit the accounts. Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary.

Leave a Reply

Want to join the discussion?Feel free to contribute!