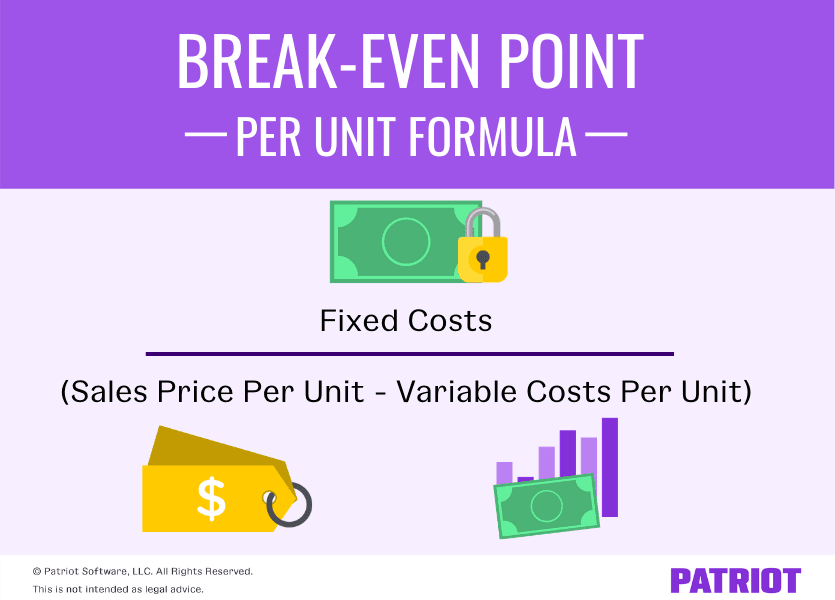

So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs. Assume a company has $1 million in fixed costs and a gross margin of 37%. In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. The breakeven formula for a business provides a dollar figure that is needed to break even.

What is the approximate value of your cash savings and other investments?

- You might decide to raise the prices, but the comparable items in the market must be considered before doing that.

- You can see that all of these costs do not change even if you increase production or make more sales in a particular month.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met. For example, if a product sells for $10 but only incurs $3 of variable costs per unit, the product has a contribution margin of $7. Note that a product’s contribution margin may change (i.e. it may become more or less efficient to manufacture additional goods). Another limitation is that the breakeven point assumes that sales prices, variable costs per unit, and total fixed costs remain constant, which is often not the case.

Build a Better Business Plan.

If you have a lease on a building or vehicle, you’ll have to make the periodic lease payments regardless of business conditions. A business cannot eliminate a fixed cost even if business conditions change. It will quickly calculate the units you need to sell to reach the break-even point (BEP). As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k. For instance, if the company sells 5.5k products, its net profit is $5k.

What is break-even analysis?

In other words, your company is neither making money nor losing it. Barbara is the managerial accountant in charge of a large furniture factory’s production lines and supply chains. The basic objective of break-even point analysis is to ascertain the number of units of products that must be sold for the company to operate without loss. In other words, the no-profit-no-loss point is the break-even point.

This can be particularly useful if you are considering break even from an overall business perspective. Increasing product lines may be a cheap solution (say you have a shop or warehouse, adding more product lines will likely add little to your holistic operational costs). When taking this approach, it is important to consider the product break even point (or line item break even point) as well as the overall break even point for the business or sub business units. If you are an Uber driver and you enter for the selling price per unit the average price per trip, then your BEP is the number of trips you must make.

It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and standard chart of accounts marketing. Generally, to calculate the breakeven point in business, fixed costs are divided by the gross profit margin. When it comes to stocks, for example, if a trader bought a stock at $200, and nine months later, it reached $200 again after falling from $250, it would have reached the breakeven point.

This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates. We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you. The other typical situation involves comparing a traditional bond with a bond with the same maturity date whose principal value automatically adjusts for inflation. In this case, you’re calculating the break-even interest rate of inflation for which buying the inflation-indexed bond will provide a larger return.

In terms of its cost structure, the company has fixed costs (i.e., constant regardless of production volume) that amounts to $50k per year. Recall, fixed costs are independent of the sales volume for the given period, and include costs such as the monthly rent, the base employee salaries, and insurance. If your break-even point seems unachievable, you can either reduce your fixed or variable costs, or consider raising your prices to lower the number of units you need to sell to break even. Yes, the break-even point can change if your fixed or variable costs change, or if you change your pricing strategy. It’s important to recalculate BEP when any major shifts occur in your business.

Leave a Reply

Want to join the discussion?Feel free to contribute!