As such, there is not the same array of guarantees that are afforded to bondholders. With preferreds, if a company has a cash problem, the board of directors can decide to withhold preferred dividends. The trust indenture prevents companies from taking the same action on their corporate bonds. The preferred dividend ratio is a formula that equals the net income of a company divided by its required preferred dividend payouts.

Noncumulative Preferred Dividends

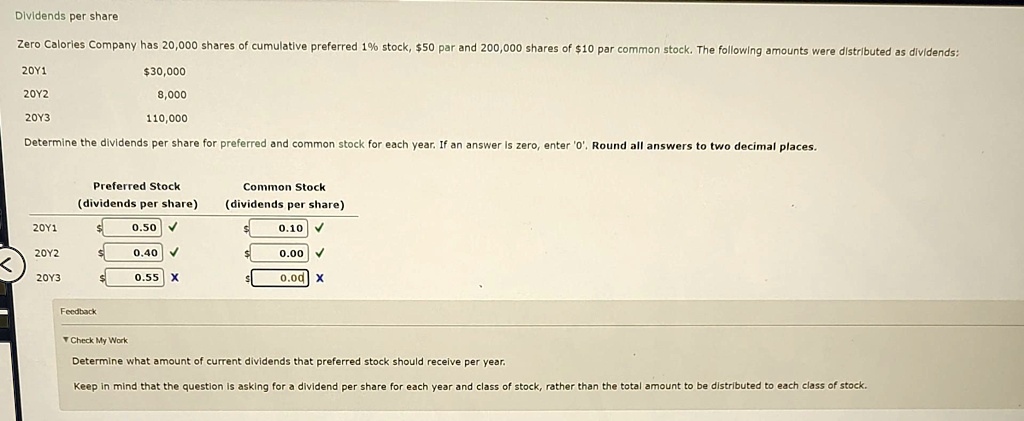

Under the terms of this arrangement, any amounts of preferred dividends not declared in a given year are carried forward into the future. They must be paid in total before any dividends are paid to common stockholders. Preferred dividends are paid before common dividends but after interest on the debt. The dividends that should be paid to the preferred shareholders get accumulated if the company doesn’t earn sufficient profit to pay them.

Video Explanation of Preferred Dividend

This is because preferred dividend payments represent obligations to preferred shareholders that the company must fulfill in the near term, usually within a year. As a result, these payments are recorded as a current liability on the company’s balance sheet until they are disbursed. In contrast to cumulative dividends, non-cumulative preferred dividends do not require the company to pay missed dividends in the future. This type of dividend is less beneficial for investors but may still appeal to those who prefer a lower-risk investment.

Dividend Payment Hierarchy

When a company’s earnings exceed the set dividend rate for preferred stock, participating preferred shareholders are entitled to a proportionate share of the excess profits. This upside participation right provides them with the opportunity to benefit from the firm’s strong financial performance. Fulfilling this obligation is critical, as cumulative preferred dividends are a legal requirement that cannot be ignored. Non-cumulative preferred dividends do not accumulate if unpaid and are not required to be paid in the future, providing less protection for shareholders compared to cumulative dividends. In times of financial distress or insolvency, preferred shareholders take precedence over common shareholders for any dividend distributions.

Join BG Vance in unlocking the path to financial freedom and realizing your dreams. This article has been a guide to what is Preferred Dividends, their formula, features, and advantages, along with practical examples. Here we also provide you with Preferred Dividends Calculator with a downloadable excel template.

Making informed decisions and choosing the best platform can maximise the benefits of preferred dividends while mitigating potential risks. When investing in the stock market actively, understanding the different types of dividends can significantly impact your financial decisions. One such type is the preferred dividend, which is tied to preferred shares, a class of ownership in a company. In this blog, you will get to know the meaning of preferred dividends and how they differ from common stock dividends, as well as highlight their importance for investors using online trading platforms.

In this case, the second threshold was exceeded and the excess was shared on the basis of total par values (one-fourth to preferred stockholders, three-fourths to common stockholders). In the absence of specifications otherwise, holders of preferred stock are entitled to receive dividends in any given year only up to a stated maximum. If they fail to receive the maximum, common stockholders receive no dividends at all.

- Investors using an online trading platform can consider preferred shares when seeking a balance between lower risk and consistent returns.

- The preferred dividend ratio is a formula that equals the net income of a company divided by its required preferred dividend payouts.

- In contrast, noncumulative preferred stock does not accumulate dividends in arrears, meaning any missed payments are forgone and cannot be claimed in the future.

- Preference accorded to cumulative preferred dividends underscores their priority over non-cumulative dividends and common stock distributions.

This feature is an advantage during challenging financial times for companies, ensuring shareholders are compensated for missed payments. Preferred stock dividend rates are usually much higher than common stock dividend rates. If a company has several simultaneous issues of preferred stock, then they tax returns might be ranked, and paid in order of preference. The highest ranked dividend is called prior, followed by first preference, second preference, and so on. Luckily, most of the time, preferred stock is given out pretty regularly, at the same price, so investors can expect dividends on a regular basis.

Companies that issue callable preferred stock may “call the stock in” — that is, the company can buy back the stock — after a certain date at a pre-specified price. A company is not obligated to call in the stock, but it might choose to do so if market dividend rates go down. For example, if a preferred stock has a 9% dividend rate, and the market rate drops to 7%, the company can get out of its obligation to keep on paying 9% dividends by calling in the stocks. In some cases, a company may pay the shareholders future dividends at the time it buys back the stock.

This is important for preferred stockholders to note, as they are now owed certain dividends. They can also be taxed at much higher rates than other dividends – sometimes as much as thirty-five percent. With that, different kinds of preferred dividends exist, with different tax consequences. True preferreds pay real dividends while trust preferreds pay interest income and are typically structured around corporate bonds. Sometimes, companies can issue both kinds of dividends, which only adds to the confusion. Trust preferreds are taxed higher, so these should only be used in things like a 401(k) or IRA since tax is a non-issue while the portfolio grows.

As with convertible bonds, preferreds can often be converted into the common stock of the issuing company. This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate. Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates.

Leave a Reply

Want to join the discussion?Feel free to contribute!