In a basic sense, Total Debt / Equity is a measure of all of a company’s future obligations on the balance sheet relative to equity. However, the ratio can be more discerning as to what is actually a borrowing, as opposed to other types of obligations that might exist on the balance sheet under the liabilities section. For example, often only the liabilities accounts that are actually labelled as “debt” on the balance sheet are used in the numerator, instead of the broader category of “total liabilities”. Another leverage ratio concerned with interest payments is the interest coverage ratio. One problem with only reviewing the total debt liabilities for a company is that they do not tell you anything about the company’s ability to service the debt.

What is a “good” debt-to-equity ratio?

- One of the main starting points for analyzing a D/E ratio is to compare it to other company’s D/E ratios in the same industry.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- The debt-to-equity ratio is a way to assess risk when evaluating a company.

- As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context.

- Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income.

On the other hand, a lower ratio may suggest the company is less risky but may not be taking full advantage of the growth opportunities debt can provide. There are various leverage ratios, and each of them is calculated differently. In many cases, it involves dividing a company’s debt by something else, such as shareholders equity, total capital, or EBITDA. Sometimes, however, a low debt to equity ratio could be caused by a company’s inability to leverage its assets and use debt to finance more growth, which translates to lower return on investment for shareholders. A company’s debt to equity ratio provides investors with an easy way to gauge the company’s financial health and its capital infrastructure.

Debt-To-Equity Ratio: Explanation, Formula, Example Calculations

For example, manufacturing companies tend to have a ratio in the range of 2–5. This is because the industry is capital-intensive, requiring a lot of debt financing to run. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware. The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76. Other definitions of debt to equity may not respect this accounting identity, and should be carefully compared. Generally speaking, a high ratio may indicate that the company is much resourced with (outside) borrowing as compared to funding from shareholders.

Part 2: Your Current Nest Egg

The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk.

Formula and Calculation of the D/E Ratio

In general, banks that experience rapid growth or face operational or financial difficulties are required to maintain higher leverage ratios. A leverage ratio may also be used to measure a company’s mix of operating expenses to get an idea of how changes in output will affect operating income. Fixed and variable costs are the two types of operating costs; depending on the company and the industry, the mix will differ.

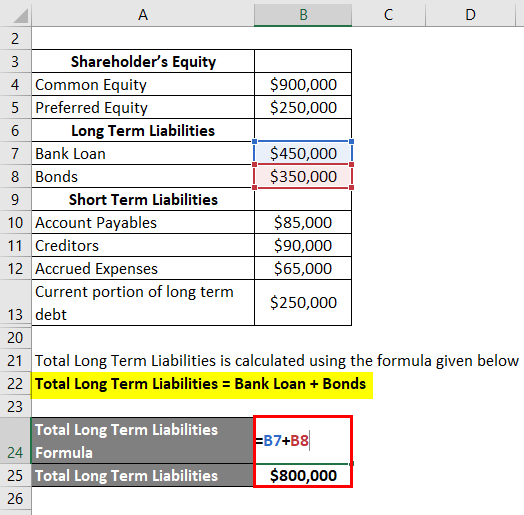

Formula:

In addition, there are many other ways to assess a company’s fundamentals and performance — by using fundamental analysis and technical indicators. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. However, an ideal D/E ratio varies depending on the nature of the business and its industry because there are some industries that are more capital-intensive than others. Current assets include cash, inventory, accounts receivable, and other current assets that can be liquidated or converted into cash in less than a year.

If a company has a low average debt payout, this implies that the company is obtaining financing in the market at a relatively low rate of interest. This advantage can make the use of debt more attractive, even if the D/E ratio is higher than comparable companies. While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own cloud vs desktop accounting financial leverage, especially when considering loans like a mortgage or car loan. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory.

While a useful metric, there are a few limitations of the debt-to-equity ratio. This figure means that for every dollar in equity, Restoration Hardware has $3.73 in debt. As noted above, the numbers you’ll need are located on a company’s balance sheet. Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more.

Leave a Reply

Want to join the discussion?Feel free to contribute!