Note that product costs are costs that go into the product while period costs are costs that are expensed in the period incurred. If you’re looking for support with tracking all the costs that go into making your business possible, FreshBooks accounting software can help. With in-depth expense tracking, powerful reporting features, and around-the-clock support, we can support your business as it scales up and reaches new heights.

Direct Labor

- Good variable expense analysis ensures you can calculate how scaling production up or down will impact the company’s bottom line.

- These are costs composed of a mixture of both fixed and variable components.

- As sales increase, the company can generate a higher profit margin due to the reduced impact of variable costs on total expenses.

- Under this method, manufacturing overhead is incurred in the period that a product is produced.

By securing better deals, longer credit terms, or bulk purchase discounts, companies can achieve significant reductions in their material costs, which constitute a large part of variable costs for many businesses. Cutting costs by sourcing lower-quality raw materials can reduce variable costs in the short term but might harm the brand’s reputation and customer trust in the long run. For instance, if a particular product has a high variable cost but generates low revenue, it might be more beneficial to divert resources to another product with a better profit margin. Cost-Volume-Profit (CVP) analysis is a financial tool that businesses use to determine how changes in costs and sales volume can affect profits. For instance, purchasing raw materials in bulk might result in discounts, thereby reducing the cost per unit. Similarly, streamlining production processes can also lead to decreased costs per item.

Operating Leverage and Variable Costs

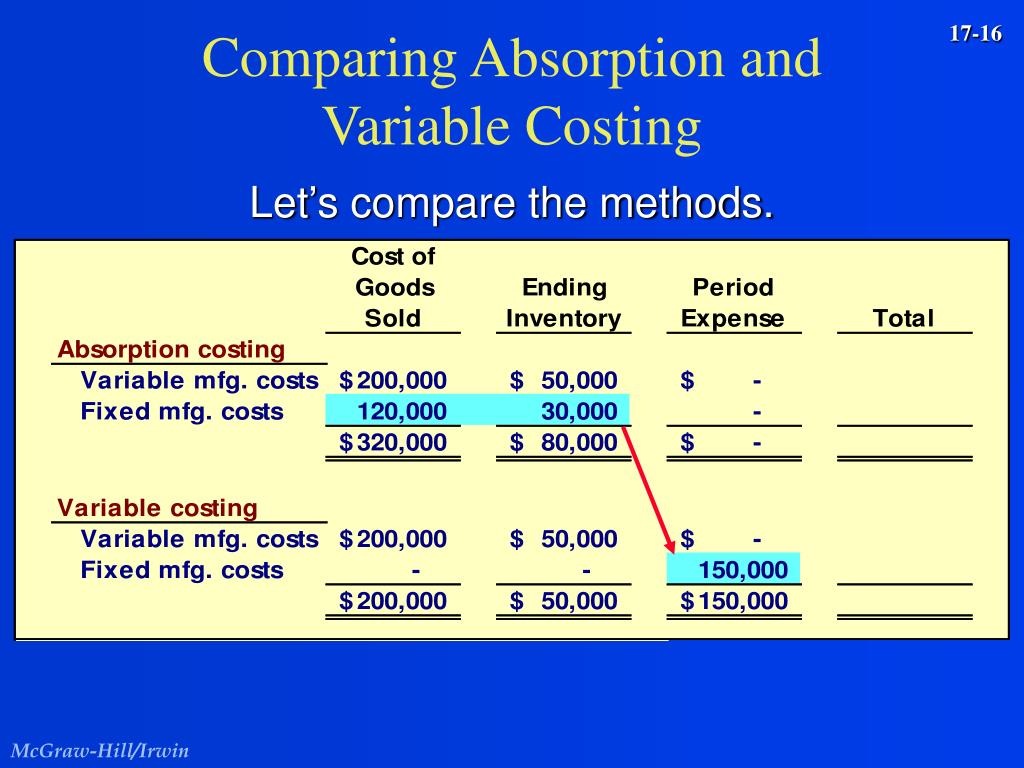

This can make it somewhat more difficult to determine the ideal pricing for a product. Variable costing results in gross profit that will be slightly higher, resulting in a slightly higher gross profit margin compared to absorption costing. Remember, you need to pay fixed costs every month in order to stay in business, or “break even.” Your break even volume is the number of units you must sell every month in order to pay your fixed costs.

Accounting Services

Conversely, ifinventories decreased, then sales exceeded production, and incomebefore income taxes is larger under variable costing than underabsorption costing. This formula demonstrates that total variable cost fluctuates based on the number of units produced, while variable cost per unit remains constant. Note how the total variable cost rises with the number of chairs produced, while the fixed cost remains the same regardless of production output. So what do you need to know about budgeting for these fluctuating costs?

What is your current financial priority?

Efficient management of variable costs is a cornerstone of successful business operations. Focusing solely on variable costs might lead businesses to overlook longer-term strategic considerations. While understanding variable costs is vital, it’s equally essential to be aware of their limitations. Implementing knowledge of variable costs can lead to improved decision-making and better business strategies.

Salaries are fixed costs because they don’t vary based on production or revenue. However, if you pay commissions for every unit sold on top of a salary, they would be variable costs. If the what is a w2 form chair company knows it costs $50 per unit in variable costs to produce a single chair, it wouldn’t make sense to price the chair any lower than $51, since you would lose money on each sale.

In other words, they are costs that vary depending on the volume of activity. The costs increase as the volume of activities increases and decrease as the volume of activities decreases. Moreover, understanding how changes in variable costs can impact profitability allows companies to make informed decisions about scaling up or down. Alternatively, advancements in technology or improved procurement strategies might lower the cost per unit, resulting in reduced variable costs. Regularly monitoring and adjusting to these shifts is crucial for maintaining profitability.

A variable cost is a type of corporate expense that changes depending on how much (or how little) your company produces or sells. Depending on how your sales or production rates are going, your variable costs can rise or fall—hence the name. Determining what constitutes a direct variable cost can sometimes be challenging. Electricity used in a production process might increase with production volume, but it’s hard to attribute a specific amount to each unit produced. For instance, sudden spikes in raw material prices or unforeseen changes in labor costs can significantly impact the variable costs of a business, affecting profitability. Variable costing excludes fixed or absorption costs, and hence profit is most likely to increase owing to the money made through the sale of the additional items.

Leave a Reply

Want to join the discussion?Feel free to contribute!