Contents:

The dragonfly doji candlestick movement of the next candlestick will provide confirmation. A dragonfly doji is a candlestick pattern described by the open, high, and close prices equal or very close to each other, while the low of the period is significantly lower than the former three. Estimating the potential reward of a dragonfly trade can also be difficult since candlestick patterns don’t typically provide price targets.

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

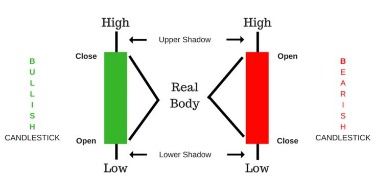

Prices will go much lower than the open price and then close the day close to or at the open price. Keep in mind that the size of a candlestick is relative and should be interpreted concerning previous candles. This pattern can either be pre or post-the price decline or rise.

Dragonfly Doji: How to Spot and Trade Candlestick Patterns

Hammer candle always has a bigger body in comparison to dragonfly doji. As we discussed above, dragonfly doji is a kind of doji candle which means they have a small body. Moreover, You should pay attention when and where this candle forms and if it’s near the support zone in a chart.

When Does A Dragonfly Doji Show Up? – Lawyer Monthly Magazine

When Does A Dragonfly Doji Show Up?.

Posted: Mon, 20 Jun 2022 07:00:00 GMT [source]

The price rolls back to the opening level by the end of a trading period. The market movement beyond the price range is the same in both directions, while the opening and closing prices are within the trading range. It means the advantage was equal in relation to both bulls and bears, which makes the bidders indecisive. The Dragonfly Doji is a helpful Candlestick pattern to help traders visually see where support and demand is was located. After a downtrend, the Dragonfly Doji can signal to traders that the downtrend could be over and that short positions could potentially be covered.

Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. The gravestone looks like an upside-down “T.” The implications for the gravestone are the same as the dragonfly. This indicates increased buying pressure during a downtrend and could signal a price move higher. The Dragonfly Doji is a relatively easy chart pattern to spot in the sense that the Japanese candlestick’s close price is equal to its open price.

How to spot Dragonfly Doji Pattern?

You can exit just below the swing low, or you can eventrail your stop lossusing a moving average structure. As a swing trader, you can look to take profit at the nearest swing high or at resistance area. Notice that the price came into the area of support, rejection of lower prices. Because if you try to do that, you’re going to suffer in trading because there are hundreds and hundreds of patterns.

When the security is showcasing a downtrend, a formation of this pattern might signal an upcoming increase in the price of the security. If the candlestick right after the bullish dragonfly closes at a higher price, then the price reversal is confirmed, and the trader can make his decision. First, you determine the timeframe, support, and resistance levels. A doji candlestick pattern works the best when trading in timeframes of one hour and longer. Dojis appear too often in shorter timeframes, and one can’t take them as serious signals for a particular price movement.

Dragonfly Doji in a Downtrend

In general, the neutral doji and the spinning top indicate uncertainty in the market, which is confirmed by their wicks . That is, the market is full of strength, both bulls, and bears. In both cases, the appearance of these candles can mean a reversal, but one should wait for additional signals as a confirmation. The long lower shadow implies that the market tested to find where demand was located and found it.

However, like all Doji, the Dragon Doji reflects some form of market indecision or hesitation. Thus, despite confirmation signals, the price may continue in the direction of the trend. However, it is essential to consider candle formations and confirm with other candlestick patterns. This candle pattern will help traders see the existence of support and demand. What does the appearance of the shooting star pattern signal on the price chart?

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

This candlestick’s presence is most significant when it appears after a downtrend, preceded by bearish candlesticks. The gravestone looks like an upside-down “T” and it has the same reversal properties as the dragonfly. It has an opposite look to the dragon fly pattern because it is formed when the open, close and low prices are equal and there is a long high wick. Traders were able to push the price higher from the session low all the way back to the open price when the previous candlesticks have been bearish. When a dragon fly doji has formed in a downtrend it is regarded as a strong signal due to the swift change of power from the sellers to the buyers. The top of a hollow body represents the close price, as the bottom represents the open price, which indicates a price increase during that period.

Types of Doji

Let’s look at an example of a doji dragonfly with a support level. This long lower wick suggests that sellers sold aggressively during the period of the candle. Since the candle closed near the open the price was able to recover and close near the high. Spinning topsappear similarly to doji, where the open and close are relatively close to one another, but with larger bodies. In a doji, a candle’s real body will make up to 5% of the size of the entire candle’s range; any more than that, it becomes a spinning top. The open, high, and close prices match each other, and the low of the period is significantly lower than the former three.

You can see that this is a Dragonfly Doji, this wick simply shows you rejection of lower prices. Don’t make this mistake of just going short just because you see a Doji in an uptrend. Often what I see traders do is that when the market moves up higher and then there’s a Doji.

What is a Doji candle pattern and how to trade with it? – Cointelegraph

What is a Doji candle pattern and how to trade with it?.

Posted: Mon, 12 Dec 2022 08:00:00 GMT [source]

Many beginner traders have come across a strange candlestick, looking like a cross with little or no body. The content on this website is provided for informational purposes only and is not intended to constitute professional financial advice. Trading any financial instrument involves a significant risk of loss. Tradingindepth.com is not liable for any damages arising out of the use of its contents. When evaluating online brokers, always consult the broker’s website. Tradingindepth.com makes no warranty that its content will be accurate, timely, useful, or reliable.

How to identify dragonfly doji?

On the second example, we see the USD/ZAR pair in also a minor downward trend. The fourth one opened slightly below where the third one closed, fell sharply, and then closed near where it opened. In this case, traders may want to see if Dragonfly has any confirmation which will be seen in its next candle or candles after it occurs. The Harami pattern consists of two candlesticks with the first candlestick being a large candlestick and the second being a small candlestick whose body is contained within the first candle’s… A Dragonfly Doji signals that the price opened at the high of the session.

When a dragonfly doji is confirmed in an uptrend it is considered a weak signal, or a continuation pattern as the buyers still managed to be active. The dragonfly doji is used to identify possible reversals and occurs when the open and closing print of a stock’s day range is nearly identical. In addition, the dragonfly doji might appear in the context of a larger chart pattern, such as the end of a head and shoulders pattern.

If you’re looking for a https://g-markets.net/ doji confirmation, you should pay attention to its next candle. Dragonfly doji candle has a different meaning in a downtrend. Because understanding the meaning is what matters, not trying to memorize the exact candlestick pattern. So again, the close and the open is the same level but the difference this time around for Dragonfly Doji is that the candle has a lower wick.

Leave a Reply

Want to join the discussion?Feel free to contribute!