Calculating the compound interest manually can be a bit tricky because it includes the number of compounding periods in a year. As such, the value of this variable has the potential to change and leaves room for error. To go about this calculation, this is the formula to follow. Here the ‘P’ refers to the Principal amount, R is the annual interest rate, and N implies the term of the loan calculated in years. Equated monthly instalment refers to the fixed amount that the borrower of a loan needs to pay to the lender at a specific date every month.

- However, as a result of it would be best to depart you cash alone for a protracted period of time, liquidity may not be a priority.

- You may consider filling up the expected rate of return and the period you plan to invest in the SIP.

- But the compound interest varies and increases across the years.

- The rate at which compound interest accumulates interest depends on the frequency – higher the number of compounding periods, higher will be the compound interest.

- With inflation, the costs of services and goods increase gradually and causes the purchasing power of currency to decline.

If the amount is compounded daily then it gets compounded 365 a year. It will generate more money compared to interest compounded monthly, which has only 12 compounding cycles per year. In all these formulas, P is the initial amount, ‘r’ is the rate of interest, and ‘t’ is the time period. This formula is known as the continuous compound interest formula and this gives the total amount after t years. Just the interest amount is calculated using the formula Pert – P as usual. We have some data in an Excel worksheet, where initial balance and the interest rate is 12%.

How to calculate recurring deposit maturity amount?

A few folks have requested a version of the above method that takes into account the variety of periodic payments . For instance, your money may be compounded quarterly however you make contributions month-to-month. In this case, you may wish to do this version of the method, initially suggested by Darinth Douglas, and then expanded upon by Jean-Baptiste Delaroche. Compound Interest occurs when interest gets added to the principal amount invested or borrowed, and then the interest rate applies to the new principal. Compound Interest can be thought of as “interest on Interest”. It will make a sum grow at a faster rate than simple interest, which is calculated on the principal amount.

It is a built-in function of Excel that is used to calculate the compound interest on some value. Similar to the above methods, it also calculates the future value on investment. Besides the above examples, we have one more example of compound interest. For this example, we have added one more term with the data, i.e., compounding period per year. This term refers to how many times interest given to the user in a year.

This is because simple interest is calculated only on the principal in every tenure, whereas compound interest is calculated on the principal amount + interest so far. Note that while finding compound interest, each time period and the rate of interest must be of the same duration. Identify the number of times the investment is compounded . The FV() function of Excel returns the future value of an investment. Although we have provided a detailed description of compound interest and calculation in Excel but if the user still not getting this, we have one more solution.

Both simple and compound interest are basic financial concepts you should know, irrespective of whether you want to borrow or invest. Understanding the compound and simple interest formula can give you invaluable insights and help you plan your finances for years to come. To understand how simple curiosity works, think about an automobile mortgage that has a $15,000 principal steadiness and an annual 5% easy rate of interest.

The longer you leave your money untouched, the greater it will grow because compound interest grows over time which means your money keeps on multiplying over a period of time. If you are repaying a loan on compound interest, you should not ignore paying the interest or if there is any delay in paying the loan, then the interest burden will be high. To take advantage of compounding, one must aim at increasing their frequency of loan payments. This way you can pay less interest than what you are liable to pay.

Let the principal be P and the rate of interest be R% per annum. Here, the interest is compounded annually, so the compounding period is 1 year. Compound Interest Calculator is a ready-to-use excel template that helps to calculate compound interest with multiple compounding periods. Compound interest excel compound interest formula calculator Law of compoundingis the backbone of financial returns through investment and security through insurance. Albert Einstein once referred to the law of compounding as the “eighth wonder of the world”. Compounding is the process of generating more return on an asset’s reinvested earnings.

How Do you Calculate Compound Interest for Half Year?

That’s why we’ve written up this step-by-step tutorial on how to use the compound interest formula in Excel to get the job done. The guideline of 72 is some other way to make estimates approximately compound interest speedy. This rule of thumb tells you what it takes to double your money, looking on the fee you earn and the length of time you’ll earn that fee.

Each one of our calculators is benchmarked against the best in the business and is ideal for everyday use. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

APY works out to be higher than the effective rate, despite maturity sum being the same. If you only have the nominal rate to work with, you can still capture the effects of compounding. Just divide the ‘r’ and multiply the ‘n’ in the above formula by the frequency of compounding. Effective rate helps determine the correct maturity amount as it accounts for the impact of compounding. The compound interest can be greater than the principal over a period of time. Simple interest is the interest calculated only on the principal , but compound interest is the interest calculated on both principal and interest together.

Monthly Compound Interest Formula

You could also use the ClearTax SIP Calculator to select your SIP instalments depending on your financial goals. This formula is relevant if the investment is getting compounded annually, implies that we’re reinvesting the cash on an annual foundation. For day by day compounding, the interest rate might be divided by 365 and n shall be multiplied by 365, assuming three hundred and sixty five days in a 12 months.

What is the formula for calculating compound interest?

Compound interest, can be calculated using the formula FV = P*(1+R/N)^(N*T), where FV is the future value of the loan or investment, P is the initial principal amount, R is the annual interest rate, N represents the number of times interest is compounded per year, and T represents time in years.

Excel offers FV() function, which is an in-built Excel function used to calculate compound interest. It means the user must know the compound interest formula and know its basic terms and usage. If the user has good knowledge of compound interest and its formulas, he/she can easily use it without wasting any time.

How to Use Groww’s Compound Interest Formula Calculator?

It never provides the interest you earn again into the calculation. Most interest bearing accounts calculate interest considered one of two methods. Schedule is a series of interest rates enclosed in curly braces.

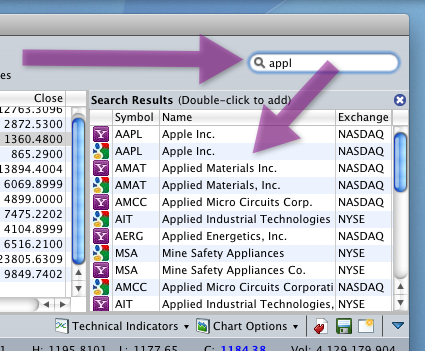

How do I calculate compound interest in Excel?

- Rate: Rate is the constant interest rate per period in an annuity.

- Nper: Nper stands for the total number of periods in an annuity.

- Pmt: PMT.

- PV: PV stands for present value.

- Type: This is an optional argument.

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. When we are calculating compound interest, the number of compounding periods makes a significant difference. If Mr. A invests the same amount where the compounding period is semi-annually. Then, the final value of the investment at the end of the period will be $1,62,826.

When it comes to simple interest, earned interest is not compounded and it is calculated only on the principal amount. All of these mean you’ll get the given rate of interest over a period of 1 year. Semi-annual is 6 months, while quarterly is 3 months in duration.

This function takes two arguments, i.e., principal and schedule. Using a similar formula as described above, let us now calculate the Future Value for the principal amount for the given period and interest rate. What proportion will your investment be worth without 5 years? Just key in nominal rate and compounding frequency in the EFFECT function. Obviously, compound interest is greater than simple interest.

Here, the interest payable is calculated based on the compounding period, which is the tenor, and then added to the principal borrowed. As such, you end up paying a higher amount or earning more when the instrument in question follows a compound interest calculation. Whether it is an investment or loan, the way in which the interest is calculated on the offering is of key importance. This ultimately dictates the total earnings or cost of the undertaking. While there are a few ways to calculate interest, for the sake of simplicity, consider the two main types.

How to calculate compound interest in Excel explain it with an example?

In cell D2, to calculate the compound interest you will want to input = C2 x 1.08. In this case, C2 contains the value $101.80, so the Excel worksheet will calculate $101.80 x 1.08 and will display $109.17. You can follow this same logic to create the formula that calculates year 3 interest in cell E2, = D2 x 1.08.

Compound curiosity is calculated by multiplying the preliminary principal amount by one plus the annual interest rate raised to the variety of compound intervals minus one. The whole preliminary quantity of the mortgage is then subtracted from the ensuing worth. If you keep a balance on your credit card, you probably pay compound curiosity, and any curiosity costs are added to the principal—making your debt develop exponentially over time.

The compounding periods are the number of times the compound interest will be calculated on the investment. PMT Excel function helps in calculating the total periodic payments done against a loan or investment at a constant rate of interest for a specific number of periods. We saw in above examples that when frequency of SIP is yearly than compounding happens on yearly basis or it happens on monthly basis when SIP is done monthly. Probably if SIP investments are done on daily basis than we might see daily compounding in mutual fund. Compounding works in Mutual Fund similar to how it works in PPF and this is exactly what we are going to see in this article with the help of Excel Examples.

Simple curiosity loans calculate curiosity on the principal stability only, so that you don’t end up paying interest on interest as you’ll with a compound interest mortgage. It plays a major role for an interest compound calculator that is interpreted and used by you as helpful and helpful by way of a compound interest calculator. For instance, you make a deposit of $6,000 into a savings account at an annual interest rate of 5%, compounded monthly. It will be 1, 2, 4, 52 and 365 for yearly, biannual, quarterly, weekly and daily compounding respectively. Once you get the effective rate, you can use it in the formula cited earlier to calculate the maturity value of your investment.

What is the formula for calculating compound interest?

Compound interest, can be calculated using the formula FV = P*(1+R/N)^(N*T), where FV is the future value of the loan or investment, P is the initial principal amount, R is the annual interest rate, N represents the number of times interest is compounded per year, and T represents time in years.

Leave a Reply

Want to join the discussion?Feel free to contribute!